Apportionment is a key concept for valuation experts. Regarding valuation assignments, apportionment is a key issue when a client wants to know the economic impact of one or more resources employed by the business, usually an intellectual property asset. Our firm specializes in the analysis and valuation of intellectual property assets (IP), therefore we encounter apportionment primarily in two contexts:

- The contribution of an IP asset such as a patent, copyright or trademark to the profits achieved by a business involved in a dispute or litigation related to a claim of infringement or misuse of an IP asset; or

- Assessing the value of an IP asset when a business plans to transfer the asset to another company, or to a subsidiary corporation in a different financial reporting jurisdiction.

Both contexts require a valuation analysis that essentially parses or assigns a portion of the total profits achieved by the business to the specific contribution of one asset employed by the business. The first context involves the use of apportionment analysis to calculate profit-derived economic damages for litigation assignments, or the value lost when infringement has occurred. The second context involves calculation of a value for assets that are being transferred from one party to another. Apportionment for both of these valuation contexts requires an understanding and review of how the specific IP asset is being used by the business.

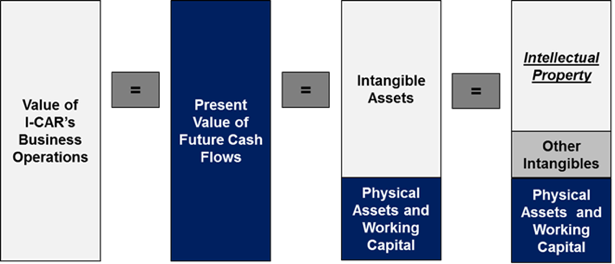

Profit Apportionment is the process of parsing the profits achieved by a business entity to the contribution made to those profits by one of the resources the business uses to achieve profits. Essentially, if a business unit is able to achieve a profit of $100, how much of this $100 was the result of using an IP asset. The value of a trademark, copyright or patent to the business that uses that asset is the present value of the portion of profits that can be apportioned to the business’ use of that asset.

The Apportionment Valuation Framework

License Agreements and Royalties as an Implied Apportionment

IP Assets can be licensed by one party, the licensor, to another party, the licensee, where the licensee is granted permission to use IP owned by the licensor in exchange for compensation. The license agreement compensation is the price paid to use the IP asset, and in many license transactions the compensation paid is a royalty. Royalties can be fixed fees, a percentage of product sales, a percentage of the licensee’s profits, or many other measures. Royalty compensation is essentially the portion of expected profits that the IP user, the licensee, is will to pay in order to achieve additional economic benefits. Therefore, a royalty is essentially an agreement to apportion the licensee’s profits between the licensee and the licensor. An IP valuation based on a relief from royalty calculation is essentially an apportionment analysis based on a hypothetical licensing arrangement, where the license compensation determines the portion of profits due to use of the IP.

Nevium Profit Apportionment Publication

Further discussion of apportionment as a key concept in IP valuation can be found in our book chapter “Profit Apportionment in Intellectual Property Infringement Damages Calculations” published as a chapter in The Comprehensive Guide to Economic Damages book by Business Valuation Resources (BVR), 2018