by Nevium | Aug 22, 2022 | Internet & Social Media

The Plaintiffs sought damages against the Defendants of “at least $1,900,000, constituting lost profits in the amount of $1,154,385, out-of-pocket mitigation expenses of $299,600, and statutory interest of $477,863. In addition, Plaintiffs claimed additional damages of “$400,000-$500,000” that they claimed would be necessary for them to hire an outside digital... Read more

by Nevium | Aug 22, 2022 | Internet & Social Media

Nevium’s Doug Bania and Edgar Bustillos present at NACVA and the CTI’s 2022 Business Valuation and Financial Litigation Hybrid and Virtual Super Conference – August 17-19, 2022. Websites are the New Corner Stores, and Foot Traffic is Search and Social Media. As more business activity occurs online and through social... Read more

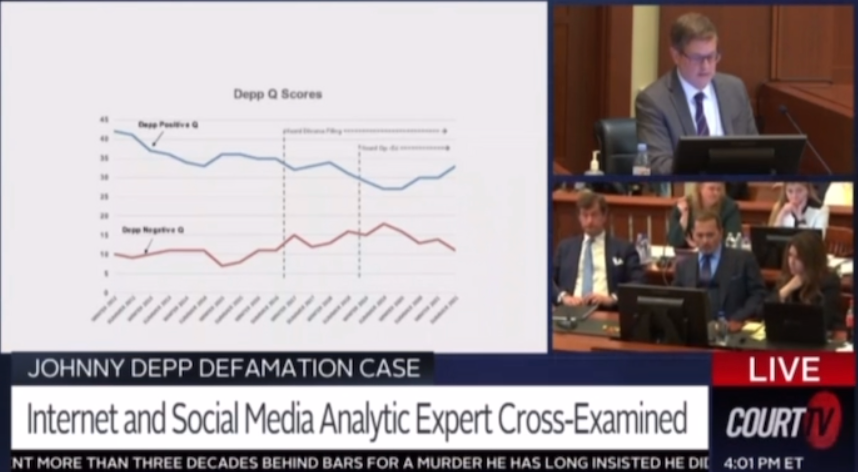

by Nevium | Jun 3, 2022 | Celebrity & Publicity, Internet & Social Media

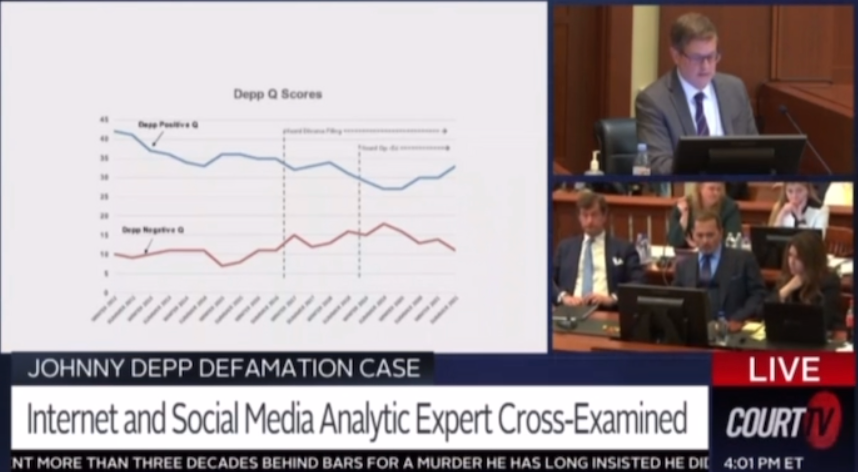

Doug Bania worked with the Brown Rudnick litigation team who won a $15M jury verdict for Johnny Depp in his defamation trial against his ex-wife Amber Heard. Mr. Bania brought internet and social media analytics into the courtroom as the facts that formed his opinions. Click below to watch part of his... Read more

by Nevium | May 11, 2022 | Celebrity & Publicity, Nevium News

Founding Principal Doug Bania spoke on panels at the 2022 International Trademark Association (INTA) Annual Meeting, the world’s premier intellectual property conference at the end of April. Doug’s discussion on the panel “Right of Publicity: The Life and Times of a Professional Football (Soccer) Player” focused on the life of... Read more

by Nevium | Apr 28, 2022 | Uncategorized

Doug Bania was appointed to the INTA 2022 – 2023 Right of Publicity (ROP) Committee. The ROP Committee develops and advocates policy on the right of publicity. The Committee monitors and analyzes developments in treaties, case law, legislation, and implementation in various jurisdictions, and proposes policy recommendations to the Board.... Read more

by Nevium | Jan 28, 2022 | Nevium News

Influencer marketing has rapidly grown, and it is predicted to be a $5-$10 billion market over the next five years, resulting in more FTC guidelines and punishments when these guidelines are not followed. There is also a growing number of lawsuits over influencers not meeting their contracts. With this in... Read more

by Nevium | Jan 20, 2022 | Nevium News

The potential for a company to expand its audience or tap into a new market by partnering with social media influencers is becoming increasingly attractive. “But the impact of social influencers can cut both ways,” Founding Principal Doug Bania told Daily News in an interview on the pros and cons... Read more

by Nevium | Nov 5, 2021 | Nevium News, Valuation

Sticks and stones may break bones, but defamatory words on the internet can break a brand. However, as internet tools become more sophisticated, businesses are more equipped to fight back and prove defamatory statements. In an article for The Intellectual Property Strategist, “Defamation Investigations: A Big Leap in Fighting Back,” Founding Principal Doug Bania explained... Read more

by Nevium | Oct 15, 2021 | Nevium News, Valuation

Online reviews have impacted businesses for a long time, but despite the potential virality in today’s landscape, businesses have more ability than ever to understand the actual impact reviews have and to prove damages. In an article for LegalTech News, “Proving Online Defamation: No Longer a Black Box,” Founding Principal... Read more