LES 2022 annual meeting: commercialization innovation

The Plaintiffs sought damages against the Defendants of “at least $1,900,000, constituting lost profits in the amount of $1,154,385, out-of-pocket mitigation expenses of $299,600, and statutory interest of $477,863. In addition, Plaintiffs claimed additional damages of “$400,000-$500,000” that they claimed would be necessary for them to hire an outside digital marketing firm “to assist in regaining its online presence.” Plaintiffs claimed entitlement to treble their actual damages in accordance with G.L c. 93A. Thus, in total, Plaintiffs sought in this case damages approaching $7 million, plus attorneys’ fees and costs.

The judge ruled “on the breach of contract claim, I award no damages. There was no bar to using “Unbreakable” in metadata or as a biddable term in Google keyword searches or in the title of and item.

Nevium’s Doug Bania and Edgar Bustillos present at NACVA and the CTI’s 2022 Business Valuation and Financial Litigation Hybrid and Virtual Super Conference – August 17-19, 2022. Websites are the New Corner Stores, and Foot Traffic is Search and Social Media. As more business activity occurs online and through social media, valuation analysts unfamiliar with these tools may find themselves left behind.

Click the link below for the presentation:

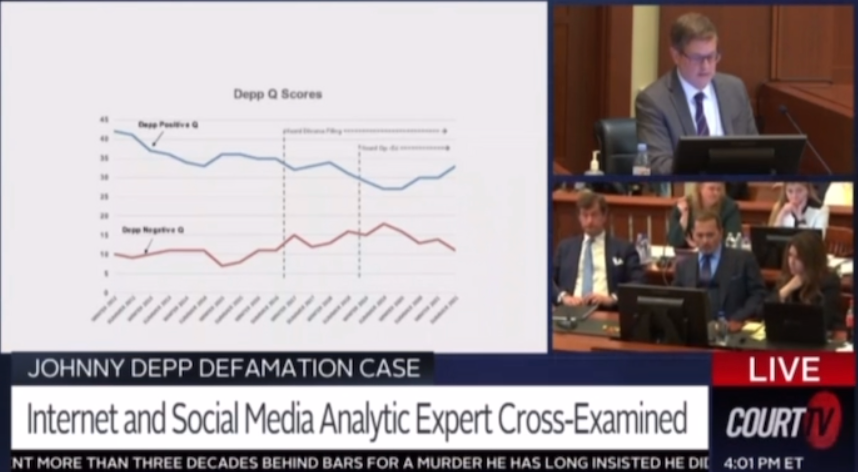

Doug Bania worked with the Brown Rudnick litigation team who won a $15M jury verdict for Johnny Depp in his defamation trial against his ex-wife Amber Heard.

Mr. Bania brought internet and social media analytics into the courtroom as the facts that formed his opinions.

Click below to watch part of his testimony.

Founding Principal Doug Bania spoke on panels at the 2022 International Trademark Association (INTA) Annual Meeting, the world’s premier intellectual property conference at the end of April.

Doug’s discussion on the panel “Right of Publicity: The Life and Times of a Professional Football (Soccer) Player” focused on the life of a fictional female soccer player from high school through college, the World Cup, eventually her professional soccer career, and then into her post-career life and death. Topics covered included basic publicity rights and emerging issues (i.e., NFTs, fantasy leagues, sports betting), the liability and damages associated with misuse of name and likeness and rights of publicity, First Amendment issues and international publicity rights. You can read the article wrap-up here.